When you move to Japan, the thing concerns you the most is the payment system and how it works. Should I consider about getting a credit card? What are the pros and cons of getting one? What about the payment schedule? Here is all you want to know.

What is a Credit Card to begin with?

a card that allows you to make a payment after your purchase for goods and services

It means when you purchasing something, you’re not actually paying your money, right?

楽天カードの場合.jpg)

Giving more example,

In case of Rakuten Credit Card for example, all purchases you make from 1st to the end of November need to be paid on the day of 27th of December. It goes the same way for December. All the purchase you make will be due on 27th of January. Now you get the payment system and the schedule of when you need money in your bank account.

You now know how a credit card works commonly in Japan.

It is time for you to look at pros and cons of having one in Japan, which is a main topic here.

Pros of Having a Credit Card in Japan

- Cashless Payment

- You can gain “Points” (“Points” are something you can get by making purchases by using a certain credit card. You can use them almost the same way as actual money)

- Effect of Visualizing Income and Expenditure

- ETC Card (Highway Card) can be attached

- Insurance can be attached

All of these will be explained by the followings.

Cashless Payment

- No handling charges of using an ATM

- No worries of cash being stolen

- Payment can be made instantly

Gosh, I ran out of cash! Ok, I’ll just go to the nearby ATM to withdraw some cash.

You need to pay a handling charge of 220-330 Japanese Yen each time you withdraw cash from ATM. But with a credit card, there will be no need for you to look for ATM or handling charges that comes with the withdraws.

And there’s definitely no fear of your wallet being stolen and all your will be gone.

In many cases, especially if it’s a huge amount of money, passcodes are required when using a credit card. This greatly contributes to preventing unauthorized use.

You can easily inactivate your credit card by calling or messaging a credit card company, which is big pro in terms of security.

Also, you can reduce the time you pay, because cashless payment is made instantly and there will be absolutely no need to count cash.

Because there will be no handling charges from withdrawing cash and no time to count it.

Gaining “Points”

- Gaining “points” allows you to make purchases more wisely.

- Why you can gain points by simply using a credit card and how you can utilize your points.

- In case of Rakuten Credit Card, 100 Japanese yen purchase equals to 1 point. You can use your points as a payment method when you shop online, restaurants and many other places.

You can get 1% back from your purchases made by a credit card

100 Japanese yen equals to 1 point, which means you will be getting 1% back from your purchases made by a credit card. This doesn’t happen when pay by cash, which is why you should be utilizing this system fully.

Rakuten Card: Points and How They Work

This shows that I have 978 Rakuten points in total, which equals 978 yen.

This means I can make a payment of 978 yen by using the points I have. And a note here is that not all

places in Japan accept payments by points.

The more Rakuten services you apply for, the more Rakuten points you will gain, because your points can

be doubled or even tripled by how many Rakuten services you subscribe to.

Rakuten services here means banking services, stocks, electricity and many more.

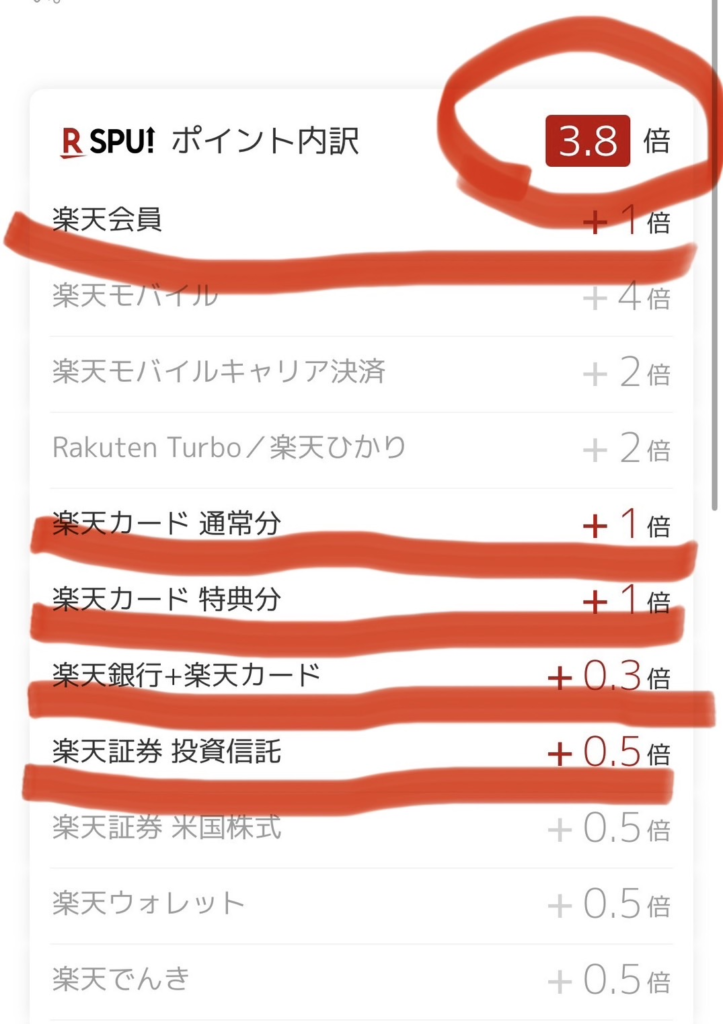

In my case for example,

Rakuten membership (×1)+ Rakuten Credit Card Ownership(×1)+Rakuten Credit Card Campaign(×1)

+Rakuten Banking Service(×0.3)+Rakuten Security Service(×0.5)=3.8 times more points in total.

I will be gaining 3.8 times more points in all of my purchases.

I can get 975 points by making a 27500-yen-purchase thanks to the fact that my points will be automatically 3.8 times more.

This roughly equals to getting 3.5% back of my purchase. How nice is that!

Effect of Visualizing Income and Expenditure

- The date of your purchase

- The amount of money you use

- To whom you paid the money

All of those payment details are recorded, and you can reference them whenever you want. If you pay by cash, it is not realistic to keep all the receipts to record the details of when, how, and how much you paid for.

It is also possible to link your credit card to your account book app to figure out your income and expenditure.

ETC Card (Highway Card) can be Attached

ETC Card (Highway Card) can be attached.

ECT Card, commonly known as Highway Card in Japanese can be attached to your credit card.

Highway fee will be paid through your credit card, which means a person you share your car with can also be benefited by owing one.

Insurance can be attached

In case of Rakuten Credit Card

- Insurance for theft and lobbery

- Insurance for traveling overseas

Insurance for theft and robbery is an insurance for the case your credit card being stolen and accidentally lost. It will compensate the money being used by someone else if you properly report it as a crime.

Insurance for traveling overseas is an insurance which compensate you or your family in case you are dead or disabled, get ill or viruses by paying you medical fee. It also applies for a case you accidentally break something and need to pay for it. Conditions differ by types of credit card, which is something you need to keep in mind, but it is certain that it will be a huge support when you travel foreign counties.

Cons of Having a Credit Card in Japan

- There is a risk of overusing

- There is a risk of your card being stolen and used by someone else

- There can be penalties if you don’t pay the dues

Now we will be looking into the cons suggested above.

Risk of Overusing

I don’t need to have cash with me. How easy it is for me to shop!

It is like as if I can buy anything.

Credit card is for people who can manage your spending.

By using credit card, there is no need for you to carry cash with you. This is because of its system that the due comes in next month. This is exactly a con for having a credit card, but this is also why you have to plan and manage your spending otherwise it might be hard for you to pay your dues.

Tip: wise and well planned for the payment comes next month.

Risk of your card being stolen and used by someone else

If your credit card is lost or stolen, it can be used by someone unknown. These days online scamming is widely spread and becoming more difficult to differentiate, which means you have to knowledgeable enough so that you won’t be scammed.

Be careful not to open e-mails that sent by unknown users. Keep your credit card securely in your purse. Those small little things can make a difference.

When you shop online, it is necessary for you to think about reliabilities of the website. You need to be careful of websites which require you credit card numbers or passcodes without proper reasons.

There can be penalties if you don’t pay the dues

I spent too much last month. I’m not sure if I can pay the dues.

【If you don’t pay the dues, the followings can happen. 】

・Delinquent charge may be required

・Your card being automatically out of use

・The delay stays in your record

Delinquent charges may be required

Initial bill × delinquent charge rate ÷ 365 × days of delay = delinquent charge

Delinquent charge rates are often 14.6% in online shopping, 20% in loans such as card loans. As you can tell the rates are set quite high. If you don’t pay the dues, especially the days of delay become longer, the more money you have to pay. This is cycle of paying money you initially don’t have to pay, which is why this should be avoided.

This tells us that you need to be will planned when using a credit card.

Risk of your credit card being out of use automatically

If you don’t pay the dues for certain amount of time, your credit card will be stopped and become out of use.

This will cause huge inconvenience in your daily lives.

The delay stays in your record

How you use your credit card or pay for your loans are recorded and the information stays.

If you don’t pay the dues, it will be recorded and the information stays. This can be a burden when you apply for loans such as housing loans or card loans, which is because you can be considered as someone not reliable enough.

Once your delays are recoded, it can stay for 5 to 10 years, which is why you have to extra careful of your dues.

Your financial record has to be clear by paying the dues with no delays. And if the delay happens, make sure to pay as fast as you possibly can.

Greater Merits Exist

Credit cards are necessities living in Japan

You now understand the pros and cos of owing a credit card in Japan. Suppose you can see greater merits of owning one if you use it in a right way.

Online shopping or payments on internet are mostly done by a credit card.

You can pay cell phone bills or life expenses with a credit card. It can create a perfect system of automatizing your monthly payments. If you haven’t got one, why don’t you get it to build and stabilize a foundation of your life in Japan.

Click HERE for more information on Rakuten Credit Card

Summary

- Cashless Payment

- You can gain “Points” (“Points” are something you can get by making purchases by using a certain credit card. You can use them almost the same way as actual money)

- Effect of Visualizing Income and Expenditure

- ETC Card (Highway Card) can be attached

- Insurance can be attached

- There is a risk of overusing

- There is a risk of your card being stolen and used by someone else

- There can be penalties if don’t pay the dues

All the way from here, we went through pros and cons of having a credit card in Japan. Were any of them new to you?

Hope this will help your understanding on credit card and finance in general in Japan.

Don’t forget to check out more information on finance in Japan on this website👍

Support Your Life in Japan

Support Your Life in Japan